Our Minister of Finance, Shrimati Nirmala Sitharaman, will present the Union Budget to the legislature. On February 1, 2023, at 11 a.m., a speech will be given at the Rashtrapati Bhavan to kick off the festivities. The public is hopeful for the upcoming budget and is looking forward to it. Depending on the national budget, there will be a number of significant announcements. Learn everything you need to know about the recent increase in the RBI Repo Rate by reading this article. Just read and find out.

RBI Repo Rate Hike 2023

The Repo rate is expected to increase, as reported by the RBI. When the 2023–24 budget is revealed, the bank will increase rates by about 25 basis points. The repo rate set by the RBI has far-reaching effects on people’s daily lives. Below, we talk about the same thing.

You probably already know that the Reserve Bank of India (RBI) is in charge of keeping the country’s economy stable. A rising repo rate means that banks will have to pay more to borrow money from the Reserve Bank of India (RBI) on short notice. Because of this, the rates at which savings, mortgages, and loans are offered will change.

RBI Repo Rate History

The Reserve Bank of India’s repo rate has undergone significant adjustments during the past several years. We’ve included a tabular breakdown of the information. Those who aren’t up to speed should keep reading so they can catch up.

| Effective Date | Repo Rate | %Change |

| 7 Dec 2022 | 6.25% | 0.35% |

| 30 Sep 2022 | 5.90% | 0.5% |

| 5 Aug 2022 | 5.40% | 0.5% |

| 8 June 2022 | 4.90% | 0.5% |

| May 2022 | 4.40% | 0.4% |

| 09 Oct 2020 | 4.00% | 0.00% |

| 06 Aug 2020 | 4.00% | 0.00% |

| 22 May 2020 | 4.00% | 0.40% |

| 27 Mar 2020 | 4.40% | 0.75% |

| 6 Feb 2020 | 5.15% | 0.25% |

| 07 Aug 2019 | 5.40% | 0.35% |

| 06 Jun 2019 | 5.75% | 0.25% |

| 04 Apr 2019 | 6.00% | 0.25% |

| 07 Feb 2019 | 6.25% | 0.25% |

| 01 Aug 2018 | 6.50% | 0.25% |

| 06 Jun 2018 | 6.25% | 0.25% |

| 02 Aug 2017 | 6.00% | 0.25% |

| 04 Oct 2016 | 6.25% | 0.25% |

| 05 Apr 2016 | 6.50% | 0.25% |

| 29 Sep 2015 | 6.75% | 0.50% |

| 02 Jun2015 | 7.25% | 0.25% |

| 04 Mar2015 | 7.50% | 0.25% |

| 15 Jan 2015 | 7.75% | 0.25% |

| 28 Jan 2014 | 8.00% | -0.25% |

| 29 Oct 2013 | 7.75% | -0.25% |

| 20 Sep 2013 | 7.50% | -0.25% |

| 03 May 2013 | 7.25% | -0.50% |

| 17 Mar 2011 | 6.75% | -0.25% |

| 25 Jan 2011 | 6.50% | -0.25% |

| 02 Nov 2010 | 6.25% | -0.25% |

| 16 Sep 2010 | 6.00% | -0.25% |

| 27 Jul 2010 | 5.75% | -0.25% |

| 02 Jul 2010 | 5.50% | -0.25% |

| 20 Apr 2010 | 5.25% | -0.25% |

| 19 Mar 2010 | 5.00% | -0.25% |

| 21 Apr 2009 | 4.75% | 0.25% |

| 05 Mar 2009 | 5.00% | 0.50% |

| 05 Jan 2009 | 5.50% | 1.00% |

| 08 Dec 2008 | 6.50% | 1.00% |

| 03 Nov 2008 | 7.50% | 0.50% |

| 20 Oct 2008 | 8.00% | 1.00% |

| 30 Jul 2008 | 9.00% | -0.50% |

| 25 Jun 2008 | 8.50% | -0.50% |

| 12 Jun 2008 | 8.00% | -0.25% |

| 30 Mar 2007 | 7.75% | -0.25% |

| 31 Jan 2007 | 7.50% | -0.25% |

| 30 Oct 2006 | 7.25% | -0.25% |

| 25 Jul 2006 | 7.00% | -0.50% |

| 24 Jan 2006 | 6.50% | -0.25% |

| 26 Oct 2005 | 6.25% | 00.00 |

When the Reserve Bank of India (RBI) wants to increase the supply of currency in circulation, it typically does so by reducing the repo rate. With the data showing a rise, the situation would be reversed.

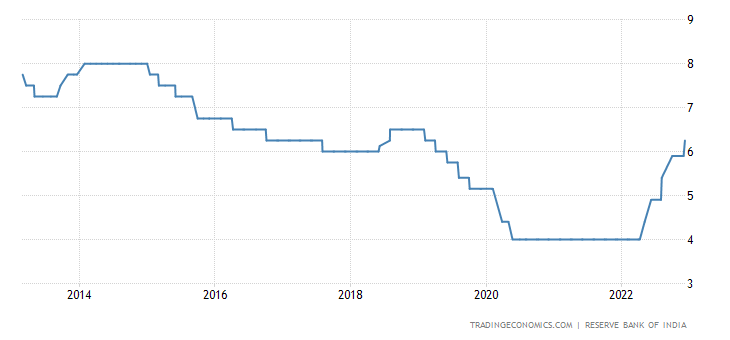

RBI Repo Rate Graph

The graph below will help you better understand the increase in the repo rate in the last ten years.

We have compiled data to assist you. Feel free to post questions or comments below.

Also, Check Below Post

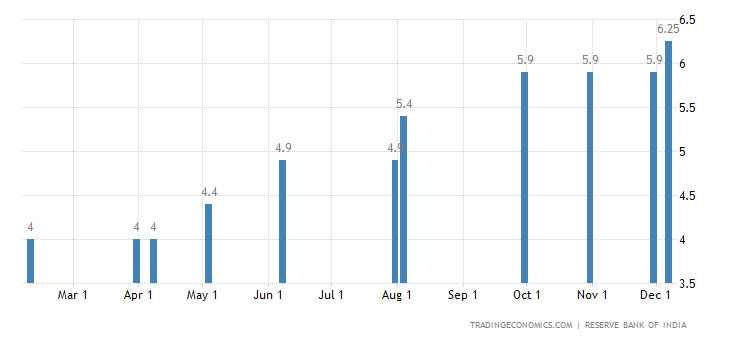

RBI Repo Rate Chart

The following bar chart displays annual statistics. The growth is plain to see, and it appears to be occurring on a monthly basis. The Reserve Bank of India (RBI) is commonly known as the banker’s bank because of the financial support it provides to commercial banks.

The result was a rise in national inflation. In December, the MPC decided to increase the Repo rate by seven. However, the current repo rate for reserves (3.25%) will not change.

RBI Repo Rate Hike Impact

In the current fiscal year, the Reserve Bank of India has raised the Repo rate four times.

- It will have repercussions on things like fixed deposits, savings, consumer purchasing, and more.

- As a result, consumers will shift to less frequent purchases, dampening demand and slowing the economy as a whole.

Reduced demand will have a chilling effect on expansion. - There will be repercussions for our economy as a result of this.

- The average person needs to approach their finances with caution if they want to maintain a healthy ratio of income to outgoing costs.

In addition to the aforementioned responsibilities, RBI is in charge of a wide range of other activities. Its choice affects the average person’s life in more ways than one.

Soon, India will unveil its spending plan for the fiscal year 2023–24. The economic status of the country and the policies that have been devised to enhance it should be taught to the masses, especially the youth.

We appreciate your interest in Techfortrade.in

Please return to our website for updates on Finance and other topics. Our website & telegram is constantly updated with new information and news.

Please leave your thoughts in the space provided below.